B2B invoices for digital goods

Multi-supplier VAT and GST for B2B digital goods invoice guide

This is a guide for developers who want to implement compliant VAT and GST invoicing for B2B digital goods transactions within a multi-supplier framework.

This guide explains how to structure VAT and GST invoices, highlighting key sections, mandatory fields to include, optional elements, and best practices for showcasing your brand while meeting legal standards. It stresses the need to comply with different regional tax rules, which can affect how the invoice looks and what information is required.

DisclaimerThis guide is provided for informational purposes only and offers a general overview of common B2B invoicing requirements. It does not constitute legal, tax, or accounting advice and should not be relied upon in place of professional consultation.

Requirements and tax names vary significantly by jurisdiction and change frequently. This information is subject to review and verification by qualified legal and tax experts in each relevant country before implementation. We based the country groupings on common patterns for typical digital goods B2B transactions. Still, they may not capture all specific nuances or exceptions regarding field format, conditional requirements (like reverse charge text), or mandatory e-invoicing data points.

Layout options

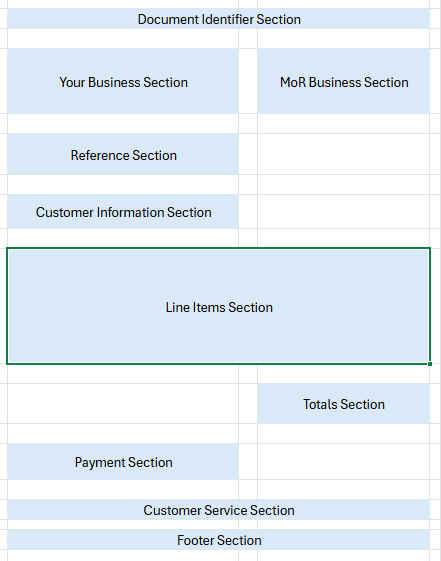

The following image shows an example of a layout option. This topic is not a layout guide; the layout may differ if you include all required items. The design must include all required fields and ensure that it reflects your brand identity, making it easier for you and your customers to process information.

Layout example

Sections

This topic outlines each invoice section's required and optional fields and data sources. For an example of an invoice's layout, see the Layout option.

You can include the following sections in a VAT or GST invoice:

- Document Identifier Section

- Your Business Section

- MoR Business Section

- Reference Section

- Customer Information Section

- Line Items Section

- Totals Section

- Payment Section

- Customer Service Section

- Footer Section

Document identifier section

The document identifier section identifies what this document is. The section includes the following field identifier:

| Field Identifiers | Field Contents | Presentation Conditions | Field Validation Notes | Data References |

|---|---|---|---|---|

Document_Type | Invoice or Credit Memo | Required | Indicate the nature of the document. Set the Document_Type to Invoice for a new purchase or Credit Memo when issuing a credit note for returns and other reversed funds. |

Your business section

The business section displays your business information. The section may include the following field identifiers:

| Field Identifiers | Field Contents | Presentation Conditions | Field Validation Notes | Data References |

|---|---|---|---|---|

YOUR_BUSINESS_LOGO | (Your business logo) | Optional | We recommend including your business logo on the invoice to help shoppers easily recognize who they purchased from. The logo's format, type, size, and placement should follow your corporate brand guidelines. | |

Your_Business_Address | [Standard Address Block, Country Code] | Optional | Provide your business address. |

MoR business section

The MoR business section displays Reach's information as the Merchant of Record (MoR). The section may include the following field identifiers:

| Field Identifiers | Field Contents | Presentation Conditions | Field Validation Notes | Data References |

|---|---|---|---|---|

|

(Reach logo) |

Optional |

Select and use the Reach logo link that best suits the style of your invoice. Your options are as follows: |

|

|

(MoR legal registered name) |

Required |

Always use the following registered name: |

|

|

[Standard Address Block, Country Code] |

Required |

Always use the following address: |

|

|

[Varies per country, when present] |

Required in certain countries |

Many countries require the buyer's Tax ID for B2B digital goods. The label (e.g., VAT ID, GSTIN) varies by country and is required where tax identification is mandated. Translate this field label when appropriate. For more information, see the Required Field Pattern for B2B Digital Goods Invoice column in VAT and GST reference. |

|

|

Required in certain countries |

See the Reach UK Tax Registration Number column in the Reach numbers for more information. |

Reference section

The reference section displays the various identifiers and references that help track and manage transactions. The section may include the following field identifiers:

| Field Identifiers | Field Contents | Presentation Conditions | Field Validation Notes | Data References |

|---|---|---|---|---|

Invoice_Number | [Invoice number] | Required | Provide the unique invoice identifier. | |

Original_Invoice_Number | [Original invoice reference] | Required only when issuing an adjustment to a previous invoice (e.g., credit note, return) | Credit notes (returns) must reference the original invoice number and date, ensuring transparency and traceability in adjustments. | |

Invoice_Date | [Invoice date] | Required | Provide the date of issue when the invoice was issued. | |

Original_Order_Reference | [Original order reference] | Required | The original order reference ID differs from the Invoice ID. Including the original order reference helps match invoices to orders, which is often necessary for both parties' records. |

Customer information section

The customer information section displays the essential details about the customer receiving the invoice. The section may include the following field identifiers:

| Field Identifiers | Field Contents | Presentation Conditions | Field Validation Notes | Data References |

|---|---|---|---|---|

Customer_Business_Name | [Customer Legal Business Name] | Required | Provide your customer's legal business name. | |

Customer_Billing_Address | '[Street, City, any Postal Code, Country] | Required | Provide your customer's billing address. | |

Customer_Shipping_Address | '[Street, City, any Postal Code, Country] | Optional | Provide your customer's shipping address. The shipping address is optional for digital goods. | |

Customer_Contact_Name | [Customer Contact First Name, Last Name] | Optional | As a best practice, include the customer's first and last name to facilitate communication and record-keeping. | |

Customer_Contact_Information | [Customer Contact Information] | Optional | As a best practice, include additional information, such as a customer's email or phone number, to facilitate communication and record-keeping. | |

Customer_Tax_or_Business_ID_Label_1 | [Varies per country, when present] | Required in certain countries | Include the customer's tax or business ID label. This label (e.g., VAT ID, GSTIN) varies by country and is required where tax identification is mandated. You can translate the field labels when appropriate. Many countries use business IDs, but only some use tax IDs for B2B digital goods. | |

Customer_Tax_or_Business_ID_Value_1 | [Customer Tax Identifier 1, when required] | Required in certain countries | Include the customer's tax or business ID value. The actual business ID or tax ID number is necessary for jurisdictions that require tax identification on invoices. | |

Customer_Tax_ID_Label_2 | [Varies per country, when present] | Required in select countries | Include the customer's second tax ID label. Countries where multiple tax IDs are mandated require a second tax label, which is uncommon globally. | |

Customer_Tax_ID_Value_2 | [Customer Tax Identifier 2, when required] | Required in select countries | Include the customer's second tax ID value. The second tax ID value is necessary only in specific jurisdictions with such requirements. |

Line items section

The line items section displays detailed information about the goods or services sold. The section includes the following field identifiers:

| Field Identifiers | Field Contents | Presentation Conditions | Field Validation Notes | Data References |

|---|---|---|---|---|

|

[Should look familiar to the customer. |

Required for each line item |

This should clarify what the customer purchased. You can include additional line items for fees when applicable. This information is critical for detailing the goods or services provided. |

|

|

[Display as number] |

Required for each line item |

Provide the number of line items. |

|

|

[Display in selling currency] |

Required for each line item |

Provide the unit price in the selling currency. |

|

|

[Display in selling currency] |

Required for each line item |

Multiply unit price times quantity; while not strictly mandated by every country, we recommend it for all countries. |

|

|

[Display as percentages per juridiction] |

Required for each line item and each jurisdiction, in jurisdictions with tax obligations |

Tax rate per line item, per jurisdiction, is required data in taxable jurisdictions. While a combined tax rate often complies with global specifications, some countries may require individual rates. Therefore, breaking out each tax rate per jurisdiction, per line item, is required to develop a single solution that remains globally compliant. Complete details are beyond the scope of this version of this document. Many global standards (e.g., Peppol BIS Billing 3.0, UBL, Factur-X) support either: Systems may break out: Peppol and similar XML schemas support tax subcomponents, and some jurisdictions may prefer this granularity for tax audits. |

|

|

[Display in selling currency] |

Required for each line item and jurisdiction in jurisdictions with tax obligations |

Display the tax amount for each line item per jurisdiction in the selling currency. Essential for B2B tax reporting. |

|

|

[Display in selling currency] |

Required for each line item |

Provide the sum of line item amounts in the selling currency. |

Totals section

The totals section displays the financial amounts related to the transaction. The section includes the following field identifiers:

| Field Identifiers | Field Contents | Presentation Conditions | Field Validation Notes | Data References |

|---|---|---|---|---|

Order_Subtotal_Excluding_Taxes | [Display in selling currency] | Required | Essential for calculating the base amount before taxes (even if tax amounts are zero). | |

Order_Total_Tax_Amount | [Display in selling currency] | Required in jurisdictions with tax obligations | Necessary for tax reporting and compliance. Clearly stating the total tax amount helps both buyer and seller in their accounting processes. | |

Grand_Total_Including_Taxes | [Display in selling currency] | Required | This value represents the total amount payable by the customer, including taxes. This field is a standard requirement on invoices globally. |

Payment section

The payment section shows the customer's payment information. The section includes the following field identifiers:

| Field Identifiers | Field Contents | Presentation Conditions | Field Validation Notes | Data References |

|---|---|---|---|---|

Payment_Information | [Varies per payment instrument] | Required | It is important to provide the payment Instrument and terms by including clear payment metadata for reconciliation and audit purposes. The payment metadata may include the payment method used (e.g., credit card, digital wallet), transaction reference number, and confirmation of payment completion. Even when no further action is expected from the customer, including this information helps align the invoice with financial records. If the customer has not yet paid, this section should instruct them on completing their payment (e.g., wire transfer). |

Customer service section

The customer service section provides contact information that the customer can use to get help. The section may include the following field identifiers:

| Field Identifiers | Field Contents | Presentation Conditions | Field Validation Notes | Data References |

|---|---|---|---|---|

Customer_Service_Email_Address | '[email address] | Optional | Provide the email address where customer can send their questions, comments, and concerns. | |

Customer_Service_Phone_Number | '[international phone number] | Optional | Provide a phone that customers can call to ask questions, share comments, or express concerns. | |

Customer_Service_Website_URL | [website URL] | Optional | Provide the URL for the customer service web portal. |

Footer section

The footer section appears at the bottom of the invoice. The section may include the following field identifier:

| Field Identifiers | Field Contents | Presentation Conditions | Field Validation Notes | Data References |

|---|---|---|---|---|

| [Your company's footer information] | [Your company's footer information] | Optional | Do not repeat information about Reach in the footer. |

VAT and GST reference

The following table shows the required field patterns for a B2B digital goods invoice and the B2B transaction task per country.

| EU | Country Names (Alphabetical) | Required Field Pattern for B2B Digital Goods Invoice | Primary Relevant Tax Name (B2B Transaction Tax) |

|---|---|---|---|

Armenia |

Standard Address Block + Required Buyer Tax ID (TIN) |

VAT (Value Added Tax) |

|

Australia |

Standard Address Block + Required Buyer Tax ID (ABN - Australian Business Number) |

GST (Goods and Services Tax) |

|

|

Austria |

Standard Address Block + Required Buyer Tax ID (VAT ID / UID - Umsatzsteuer-Identifikationsnummer) |

VAT (Value Added Tax) |

Bahrain |

Standard Address Block Only |

VAT (Value Added Tax) |

|

|

Belgium |

Standard Address Block + Required Buyer Tax ID (VAT ID / BTW/TVA/MWSt-identificatienummer) |

VAT (Value Added Tax) |

|

Bulgaria |

Standard Address Block + Required Buyer Tax ID (VAT ID) |

VAT (Value Added Tax) |

Canada |

Standard Address Block + Required Buyer Tax ID (GST/HST, PST/QST IDs where applicable) |

GST/HST & Provincial Sales Taxes |

|

Chile |

Standard Address Block + Required Buyer Tax ID (RUT - Rol Único Tributario) |

VAT (Value Added Tax) |

|

|

Croatia |

Standard Address Block + Required Buyer Tax ID (VAT ID / OIB - Osobni identifikacijski broj) |

VAT (Value Added Tax) |

|

Cyprus |

Standard Address Block + Required Buyer Tax ID (VAT ID) |

VAT (Value Added Tax) |

|

Czech Republic |

Standard Address Block + Required Buyer Tax ID (VAT ID / DIČ - Daňové identifikační číslo) |

VAT (Value Added Tax) |

|

Denmark |

Standard Address Block + Required Buyer Tax ID (CVR/VAT ID) |

VAT (Value Added Tax) |

Egypt |

Standard Address Block + Required Buyer Tax ID (TIN) |

VAT (Value Added Tax) |

|

|

Estonia |

Standard Address Block + Required Buyer Tax ID (VAT ID) |

VAT (Value Added Tax) |

|

Finland |

Standard Address Block + Required Buyer Tax ID (VAT ID) |

VAT (Value Added Tax) |

|

France |

Standard Address Block + Required Buyer Tax ID (VAT ID) |

VAT (Value Added Tax) |

Georgia |

Standard Address Block + Required Buyer Tax ID (ID Number) |

VAT (Value Added Tax) |

|

|

Germany |

Standard Address Block + Required Buyer Tax ID (VAT ID / USt-IdNr - Umsatzsteuer-Identifikationsnummer) |

VAT (Value Added Tax) |

|

Greece |

Standard Address Block + Required Buyer Tax ID (VAT ID / AΦΜ - Arithmos Forologikou Mitroou) |

VAT (Value Added Tax) |

|

Hungary |

Standard Address Block + Required Buyer Tax ID (VAT ID / Adószám) |

VAT (Value Added Tax) |

Iceland |

Standard Address Block + Required Buyer Tax ID (VAT ID / VSK Númer) |

VAT (Value Added Tax) |

|

India |

Standard Address Block + Required Buyer Tax ID (GSTIN - Goods and Services Tax Identification Number) |

GST (Goods and Services Tax) |

|

|

Ireland |

Standard Address Block + Required Buyer Tax ID (VAT ID) |

VAT (Value Added Tax) |

|

Italy |

Standard Address Block + Required Buyer Tax ID (VAT ID / Partita IVA or Codice Fiscale) |

VAT (Value Added Tax) |

Japan |

Standard Address Block + Specific JCT Invoice System Requirements (Includes Seller's Qualified Invoice Issuer Registration Number and potentially specific transaction details required for buyer's Consumption Tax input credit) |

Consumption Tax (JCT - Japan Consumption Tax) |

|

Kazakhstan |

Standard Address Block + Required Buyer Tax ID (BIN - Business Identification Number or TIN) |

VAT (Value Added Tax) |

|

|

Latvia |

Standard Address Block + Required Buyer Tax ID (VAT ID) |

VAT (Value Added Tax) |

Liechtenstein |

Standard Address Block + Required Buyer Tax ID (Tax ID) |

VAT (Value Added Tax) (Follows Swiss rules) |

|

|

Lithuania |

Standard Address Block + Required Buyer Tax ID (VAT ID) |

VAT (Value Added Tax) |

|

Luxembourg |

Standard Address Block + Required Buyer Tax ID (VAT ID) |

VAT (Value Added Tax) |

Malaysia |

Standard Address Block + Required Buyer Tax ID (TIN) |

SST (Sales and Service Tax) |

|

|

Malta |

Standard Address Block + Required Buyer Tax ID (VAT ID) |

VAT (Value Added Tax) |

Netherlands |

Standard Address Block + Required Buyer Tax ID (VAT ID / BTW-nummer) |

VAT (Value Added Tax) |

|

New Zealand |

Standard Address Block + Required Buyer Tax ID (IRD Number) |

GST (Goods and Services Tax) |

|

Norway |

Standard Address Block + Required Buyer Tax ID (Organization number / VAT number) |

VAT (Value Added Tax) |

|

|

Poland |

Standard Address Block + Required Buyer Tax ID (VAT ID / NIP - Numer Identyfikacji Podatkowej) |

VAT (Value Added Tax) |

|

Portugal |

Standard Address Block + Required Buyer Tax ID (VAT ID / NIF - Número de Identificação Fiscal) |

VAT (Value Added Tax) |

|

Romania |

Standard Address Block + Required Buyer Tax ID (VAT ID / CUI - Cod Unic de Înregistrare) |

VAT (Value Added Tax) |

Saudi Arabia |

Standard Address Block + Required Buyer Tax ID (VAT TIN) |

GST (Goods and Services Tax) |

|

Singapore |

Standard Address Block + Required Buyer Tax ID (UEN - Unique Entity Number for the Business) |

GST (Goods and Services Tax) |

|

|

Slovakia |

Standard Address Block + Required Buyer Tax ID (VAT ID / IČ DPH - Identifikačné číslo pre daň z pridanej hodnoty) |

VAT (Value Added Tax) |

|

Slovenia |

Standard Address Block + Required Buyer Tax ID (VAT ID) |

VAT (Value Added Tax) |

South Africa |

Standard Address Block + Required Buyer Tax ID (Tax Reference Number) |

VAT (Value Added Tax) |

|

South Korea |

Standard Address Block + Required Buyer Tax ID (Business Registration Number) |

VAT (Value Added Tax) |

|

|

Spain |

Standard Address Block + Required Buyer Tax ID (VAT ID / NIF - Número de Identificación Fiscal) |

VAT (Value Added Tax) |

|

Sweden |

Standard Address Block + Required Buyer Tax ID (VAT ID / Momsregistreringsnummer) |

VAT (Value Added Tax) |

Switzerland |

Standard Address Block + Required Buyer Tax ID (VAT Number) |

VAT (Value Added Tax) |

|

Taiwan |

Standard Address Block + Required Buyer Tax ID (EIN - uniform enterprise identification number) |

VAT (Value Added Tax) |

|

Thailand |

Standard Address Block + Required Buyer Tax ID (Tax ID Number / TIN) |

VAT (Value Added Tax) |

|

Turkey |

Standard Address Block + Required Buyer Tax ID (Vergi Kimlik Numarası - VKN or Tax Identification Number) |

VAT (Value Added Tax) |

|

United Arab Emirates |

Standard Address Block Only |

VAT (Value Added Tax) |

|

United Kingdom |

Standard Address Block + Required Buyer Tax ID (VAT Number) |

VAT (Value Added Tax) |

|

Uzbekistan |

Standard Address Block + Required Buyer Tax ID (INN - Individual Taxpayer Number) |

VAT (Value Added Tax) |

|

Vietnam |

Standard Address Block + Required Buyer Tax ID (MST - Mã số thuế) |

VAT (Value Added Tax) |

Reach UK tax registration numbers

Reach applies the correct indirect or consumption tax per "Ship to" country and Tax Name using the appropriate Reach UK Tax Registration Number (Tax ID). Understanding how these elements connect helps you keep accurate records, make quick payments, and meet industry rules. If you need these tax registration numbers, contact your Reach Account Manager.

Updated 25 days ago